Helping investors find the right replacement property for their 1031 Like-Kind Exchange.

1031 exchanges, also known as like-kind exchanges, can be a great benefit for real estate investors, and can result in substantial tax savings. In a 1031 exchange, the Internal Revenue Service allows for the taxes on the sale of real estate investments to be delayed, so your capital can grow on a tax-deferred basis.

While these types of transactions are attractive, they can often be difficult to conduct. As with most things involving the government, there is a great deal of compliance, and must occur during a tight timeframe. The 1031 exchange experts with RCA have years of experience representing clients in these transactions.

Curious about an international exchange? Go here.

If you would like to learn more about the benefits of a 1031 tax deferred exchange, turn to the experts at Realty Capital Analytics.

We will guide you through the entire process, from selling your current asset(s), to locating the best replacement(s), and ensuring every detail is executed with precision. Start by exploring how much in capital gains taxes you may be able to defer using our Capital Gains Tax Calculator.

Our 1031 Tax Deferred Exchange Advisory Services Include:

Connecting you with our Qualified Intermediaries

Locating and negotiating the best replacement properties

Developing the best exchange strategy and selecting the right type of exchange

Connecting you with our 1031 Exchange Attorneys and Financial Advisors

Guiding you through the entire 1031 Exchange process

Ensuring strict compliance with U.S. IRS Code § 1031

Why Consider a 1031 Exchange?

Defer Taxes

Greater Purchasing Power

Improve Cash Flow

Diversify or Consolidate a Real Estate Portfolio

Build & Preserve Wealth

Switch Property Types

Expand into Other Real Estate Markets

Estate Planning

General Requirements for a 1031 “Like Kind” Exchange:

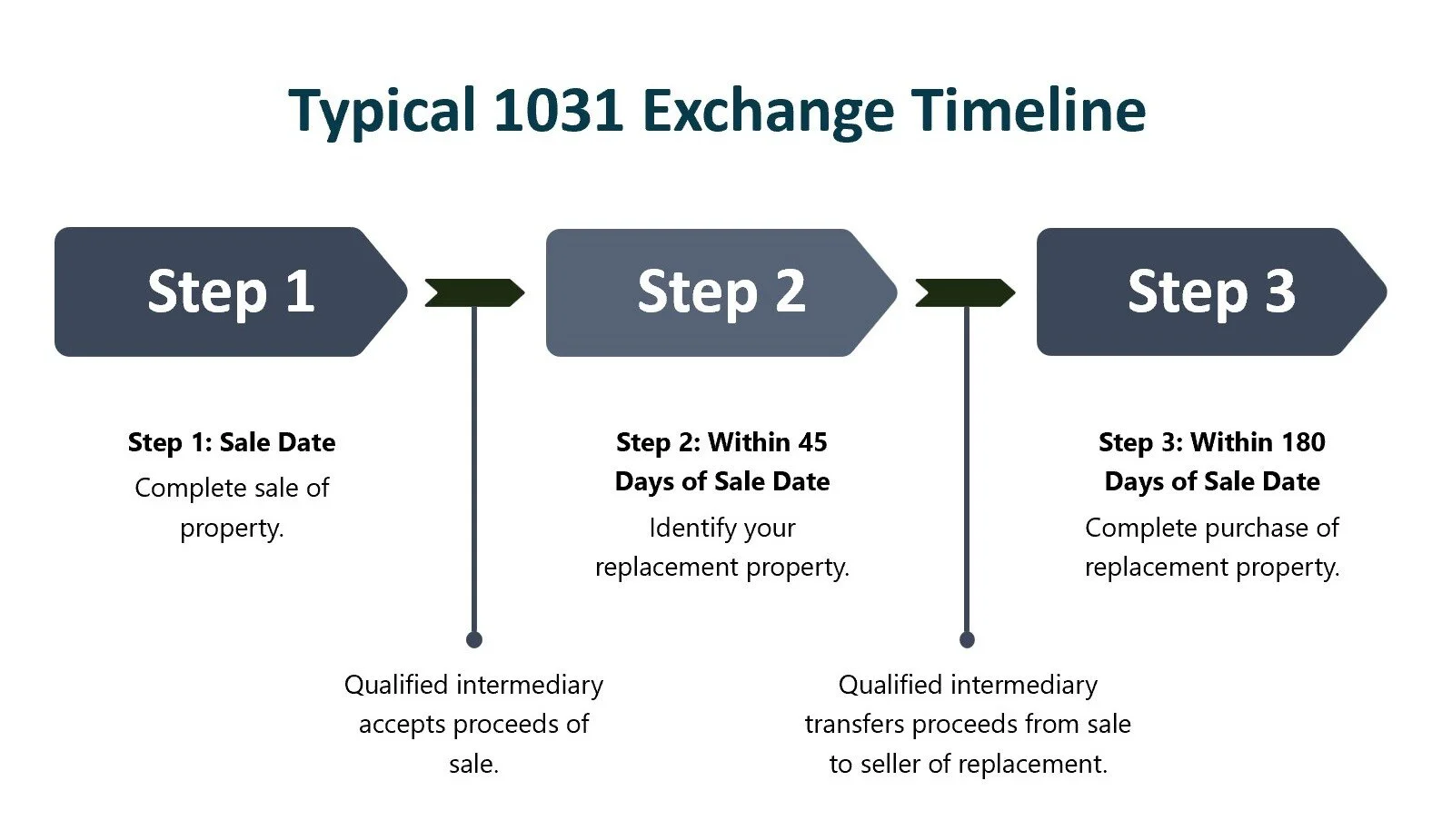

Like Kind Exchange Timeline Requirements

Measured from when the property you’re selling closes, you have 45 days to identify potential replacement properties, and 180 days to close on the acquisition the replacement property. The exchange is typically completed in 180 days, not 45 days plus 180 days.

There are two key deadlines that the Exchanger must meet to have a valid exchange:

Identification Period: Within 45 calendar days of the transfer of the first relinquished property, the replacement property to be acquired must be identified.

Exchange Period: The person doing the exchange must receive the replacement property within the earlier of, 180 calendar days after the date on which the relinquished property was sold, or the due date (including extensions) for the tax year in which the transfer of the first relinquished property occurs.

The time periods for the 45 day Identification Period and the 180 day Exchange Period are very strict and cannot be extended even if the 45th day or 180th day falls on a Saturday, Sunday or legal holiday. They may, however, be extended by up to 120 days if the taxpayer qualifies for a disaster extension under Rev. Proc. 2007-56.

Like Kind Exchange Identification Rules

For “identification” of the replacement property, you are required to provide in writing an “unambiguous description” of the potential replacement property prior to midnight on the 45th day. A legal description or property address will suffice. If you wish to identify or purchase multiple properties, you must follow one of the following guidelines:

Identify up to three properties of any value with the intent of purchasing at least one.

Identify more than three properties with an aggregate value that does not exceed 200% of the market value of the relinquished property.

Identify more than three properties with an aggregate value exceeding 200% of the relinquished property, knowing that 95% of the market value of all properties identified must be acquired.

A word about international or foreign property exchanges:

Exchangers may freely exchange properties throughout the United States, trading property in one state for replacement property in another state; however, foreign real property is NOT like-kind to United States real property, which is generally limited to the 50 states and the District of Columbia. Also note that property located in other U.S. Territories, such as Puerto Rico and American Samoa, is NOT like-kind to property located within the United States.

U.S. taxpayers anticipating a gain on the sale of foreign property and intending to buy another foreign property may benefit by structuring the transaction as a 1031 exchange because foreign property is considered to be like-kind to other foreign property.

STILL HAVE QUESTIONS?

SEE BELOW

Our Most Frequently Asked 1031 Tax Deferred Exchange Questions

1. What Qualifies as a Like-Kind Exchange?

In order to qualify as a 1031 exchange, the assets must be like-kind and also must be for investment or business purposes. You do not have to buy the same type of property or same quality though.

The term like-kind property refers to two real estate assets of a similar nature regardless of grade or quality that can be exchanged without incurring any tax liability. The Internal Revenue Code (IRC) defines a like-kind property as any held for investment, trade, or business purposes under Section 1031, making them a 1031 exchange. This means both properties involved in the exchange must be for business or investment purposes. Personal residences, therefore, do not qualify as like-kind properties.

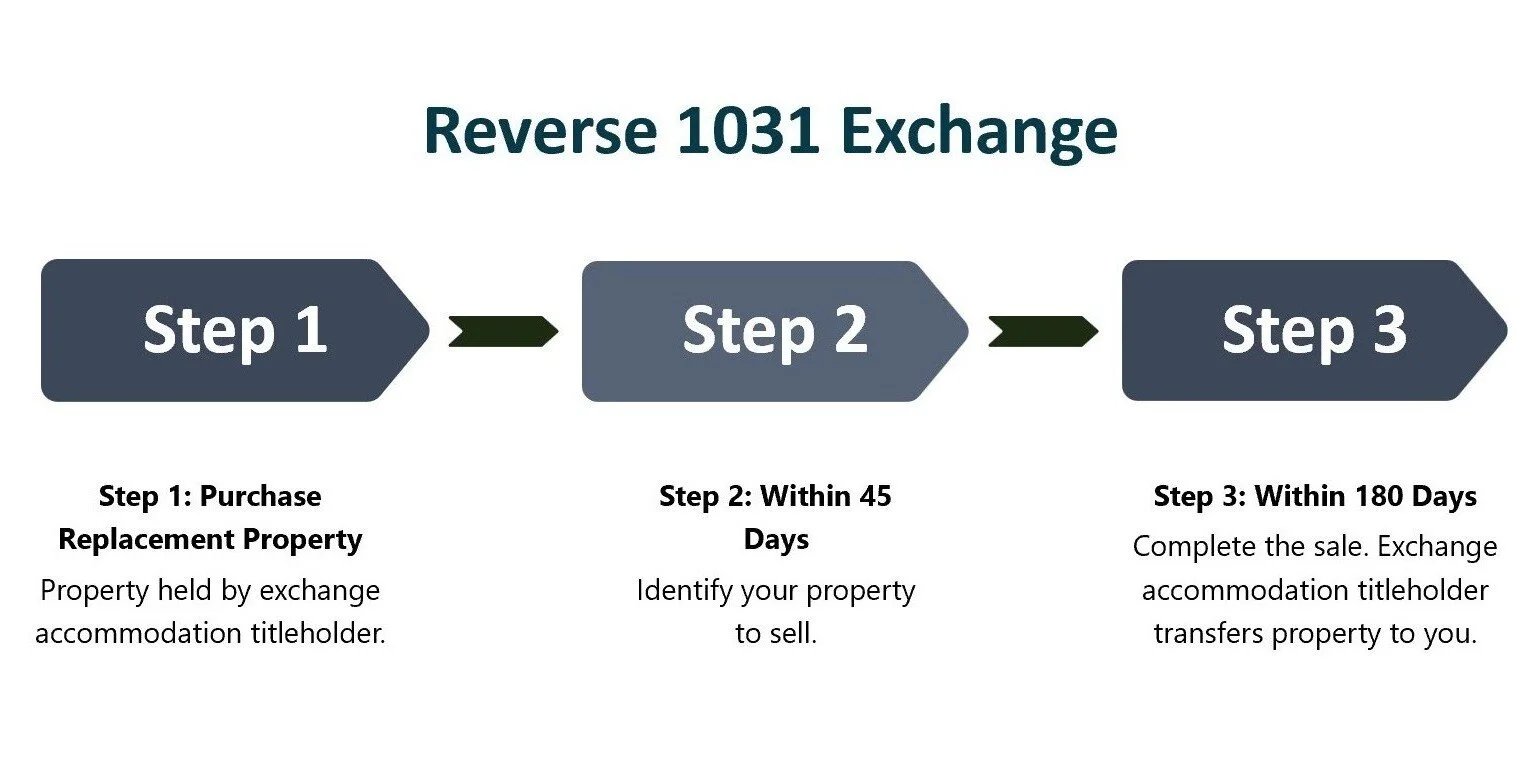

2. What is the 1031 Exchange Timeline?

This depends on the type of exchange used, but in your typical delayed 1031 exchange you have 45 days to identify the replacement property and 180 days to finalize the purchase.

Typically measured from when the relinquished property closes, the Exchangor has 45 days to identify potential replacement properties, and 180 days to acquire the replacement property. The exchange is completed in 180 days, not 45 days plus 180 days.

3. How long do I Have to Keep a Property I Bought in a 1031 Exchange?

In most cases there is no stipulated minimum, but generally it’s accepted that 12 months is the minimum hold period to avoid tax consequences and issues with the IRS. If you hold it for less, the IRS could say you had no intention of holding it as an investment. You may be required to hold for a minimum of 24 months if you are related parties.

4. Can I Take Cash Out of a 1031 Exchange?

Yes, but it is subject to capital gain taxes and there is a certain process. Cash can be taken during the sale and funds will be paid directly to you before the 1031 exchange begins.

On the other hand, if the replacement property is of a lower price than the sold property, the difference will be given to you upon purchase and you’ll be subject to your taxes.

If you take out cash during the exchange process, it can invalidate the entire thing.

5. Can I do a Partial 1031 Exchange?

You are not required to use the entire value of the property you sell. The difference can be kept by you and it is also known as a boot or cash boot. It’s important to note that this money is not deferred and there are rules as to when and how you can take the cash.

6. How Does Sales Tax Apply?

The 1031 exchange is a system to defer your federal tax liability. You may still be subject to state or municipal taxes. In many instances you can also defer or avoid these as well, but you will need to speak to a professional that can help you navigate your local tax rules.

7. What About Transfer Taxes?

While the property is technically transferred twice – first to a qualified intermediary, then to you, it is considered a direct transfer. As such you should not be subject to multiple transfer taxes and there is no penalty for having an intermediary.

8. Can You do a 1031 in a Syndication?

The simple answer is that pooled investments cannot invest using a 1031 exchange because the owners are required to be the same for both the purchase and the sale. So, if you are part of a syndication, you generally cannot make another purchase using a 1031 unless every member and their contributions have not changed.

But, there are a couple ways to invest using a 1031 exchange and also have a pooled investment structure.

Alternately, you can invest using what’s called a TIC, or tenants in common. With this structure you can invest alongside other investors and use a 1031.

Alternately a Delaware statutory trust, or DST is also an acceptable structure for investing using a 1031 exchange.

9. What is a Delaware Statutory Trust (DST)?

The Delaware Statutory Trust (DST) is a legal entity created and often used in real estate investing that allows for a number investors to pool money together and hold fractional interests in the holdings and assets of the trust.

While there are important legal distinctions, a DST is similar in function to a limited partnership, where a number of partners (or owners) pool investment money together for investment purposes in which a master partner will manage the assets that are owned by the trust. Similar to a limited partnership or LLC, the DST will provide owners with limited liability and pass through income and cash distributions to the minority owners.

The DST has become a widely used structure for pooled real estate investment following a 2004 IRS ruling that allowed ownership interests in the DST to qualify as a like-kind property for use of in a 1031 exchange, which allows sellers of real estate to defer capital gains.

10. How Does a Delaware Statutory Trust (DST) Work?

Generally speaking, a sponsor will set up the DST and name trustee(s) who will have sole authority to manage the business and assets of the trust. The trustees will have a fiduciary responsibility to the beneficial owners.

The trust will collect the investment money, arrange any financing necessary on behalf of the trust, and make and manage or hire property managers. The trust itself holds direct ownership of the assets with the individual owners owning an interest (or share) in the trust.

Similar to a limited liability company (LLC), all income and distributions are passed through and taxed to the individual owners. The typical life of a trust can vary greatly but could easily be ten years in which property is acquired, income collected and distributed to owners and when, upon disposition of assets, remaining capital is returned to investors.

The trust provides limited liability to the trustees, managers and beneficial owners of the trust, and as a trust rather than an LLC or partnership is very simple and inexpensive for the sponsor to create and operate.

11. What are the g(6) restrictions, and what does it have to do with the cash I receive?

In an exchange, the taxpayer will not receive proceeds from the sale of a relinquished asset and use those proceeds to buy the replacement asset (that would be a taxable sale, regardless of the like-kind purchase). Rather, the taxpayer is trading with the relinquished assets for the replacement assets and never takes possession of the sale proceeds. Proceeds from the sale of relinquished property are securely held by the exchange company, known as the qualified intermediary ,until they are applied towards the purchase of the replacement asset(s) identified by the taxpayer. The g(6) restrictions provide that the exchange agreement must expressly limit the taxpayer's rights to receive, pledge, borrow, or otherwise obtain the benefits of the cash in the account. The regulations further provide if the exchange is unsuccessful after certain timelines pass, all the funds can be returned to the taxpayer.

12. What are the Related Party Rules?

To prevent the possible abuse of like-kind exchanges, certain persons or entities that are “related” to the taxpayer cannot sell the replacement property to the taxpayer. However, it is permissible for the taxpayer to sell the relinquished property to a related party, generally defined as family members, partnerships in which a common owner owns more than 50% of both partnerships, and corporations in which a common owner owns more than 50% in each.

13. What are the Required Documents for a 1031 Exchange?

Documents are typically provided by the qualified intermediary and facilitated by your consulting firm. They generally consist of an Exchange Agreement, assignments of certain rights the taxpayer has in the sale and purchase agreements, notices to the seller and buyer of the assignments, and a form to designate the possible replacement properties within the 45 day window.

14. What are the Notification Requirements?

This is a technicality under the rules. When a taxpayer is transferring ownership of an asset to or from the exchange company, it can be done via an assignment of the taxpayer’s interests under the purchase and sale agreement; however, to perfect this process under the IRS rules, the buyer and seller must receive written notice that this assignment of rights has taken place. Neither the buyer nor seller need to do anything affirmative in connection with providing them notice of the assignment, however it is common to request the buyer or seller provide a signature receipt upon receiving a copy of the notice so that the taxpayer has a simple way of confirming compliance in the event of an audit. Also, the regulations state that all parties to a contract must receive notice of the taxpayer’s assignment of rights. Accordingly, if the taxpayer is one of several sellers or one of several buyers, the additional sellers and buyers should be given notice of the taxpayer’s assignment of rights as well as the taxpayer’s counter party.

15. What State Regulatory Requirements May Impact My Exchange?

Several states contain regulations regarding the activities of exchange companies in connection with real estate or personal property being sold which is held in that state. Generally, so long as the qualified intermediary is licensed or otherwise in compliance with any applicable state requirements, the taxpayer does not have to be concerned with the regulations affecting the qualified intermediary’s state activities.

There are some states, such as California, which require the qualified intermediary to remit directly to the state’s franchise tax board the sum of 3.3% of any cash left in the exchange account at the conclusion of the exchange. That sum is a down payment on the full capital gain payable to the state. Funds can be left in the account due to a failure to conclude an exchange or due to the fact that the taxpayer used up some, but not all, of the exchange funds. Also, some states have “clawback” rules where a taxpayer may sell relinquished property in the state and acquire replacement property in another state resulting in tax deferral in the first state. Later, if the taxpayer sells the replacement property without a further exchange, the capital gain is payable back to the first state where the relinquished property was sold.

16. How are Real Estate Taxes Handled in a Like-Kind Exchange?

In an exchange context, relinquished property is transferred from the taxpayer to the qualified intermediary, and from the qualified intermediary to the buyer. Likewise, the replacement property is being transferred from the seller to the qualified intermediary and from the qualified intermediary to the taxpayer. However, the transfer tax that would otherwise be due on the transfers to and from the qualified intermediary do not result in an extra transfer tax. The reason for this is that the regulations allow for a “direct” deed to be given from the taxpayer to the buyer and from the seller to the taxpayer. So for exchange purposes, the properties are deemed transferred to and from the qualified intermediary while for title and transfer tax purposes they are treated as direct transfers from the taxpayer to the buyer and to the taxpayer from the seller.

17. How is Sales Tax Handled in a 1031 Exchange?

Generally speaking, sales tax due upon the disposition of the relinquished property should be remitted directly from the buyer to the seller, or to the sales taxing authority. Sales proceeds may be used to pay the sales tax due on the purchase of the replacement property, but requires coordination and approval from the taxpayer’s tax advisory professionals.

It’s important to note that the federal law governing like-kind exchanges is focused strictly on income taxation, while sales tax law is typically a state and local matter. However, through careful planning, it is possible to combine the benefits of trade-in treatment with like-kind exchange treatment.

18. What Issues Are There Surrounding Debt Refinancing?

There is nothing explicit in the regulations on this issue, however it is generally understood that a post-exchange refinance should not affect the validity of the prior exchange. It is recommended that the refinance should not be prearranged prior to the acquisition of the replacement property. For various reasons, absent sound business reasons, it is not recommended to put debt on relinquished property in anticipation of its sale.

19. What are the rules related to identifying replacement properties?

As the Exchangor, you are required to provide an “unambiguous description” of the potential replacement property on or before the 45th day after closing on the relinquished property. (A legal description or property address will suffice). If you wish to identify or purchase multiple properties, you must follow one of the following guidelines:

Identify up to three properties of any value with the intent of purchasing at least one.

Identify more than three properties with an aggregate value that does not exceed 200% of the market value of the relinquished property.

Identify more than three properties with an aggregate value exceeding 200% of the relinquished property, knowing that 95% of the market value of all properties identified must be acquired.

20. What if I do an exchange and take money out, or acquire a property of lesser value?

An exchange is not an “all or nothing” proposition. You may proceed forward with an exchange even if you take some money out to use any way you like. You will, however, be liable for paying the capital gains tax on the difference (“boot”).

There’s a common misconception amongst Exchangors on how much money needs to be re-invested when participating in an exchange. In order to be 100% tax deferred, you must re-invest in a property that is equal to or greater than the sales price of the property you are relinquishing. If you choose to go down in value or choose to pull some equity out, an exchange is still possible, but you will have tax exposure on the reduction, or the “boot”.

21. Is it possible to exchange out of one property into several?

It does not matter how many properties you are exchanging in or out of (1 property into 5, or 3 properties into 2) as long as you go across or up in value, equity and mortgage. The only concern with exchanging into more than three properties is working within the time and identification restraints of section 1031.

22. What if I want to acquire a property in a different state than the one I’m selling?

Exchanging property across state borders is a very common thing for investors to do. It is important to recognize, however, that the tax treatment of interstate exchanges vary with each state and it is important to review the tax policy for the states in question as part of the decision-making process.

23. Would I be able to convert an investment property into a primary residence and sell it? What is Section 121?

The IRS realizes that a person’s circumstances may change; therefore, a property may change in character over time. For this reason, it is possible for an investment property to eventually become a primary residence. If a property has been acquired through a 1031 Exchange and is later converted into a primary residence, it is necessary to hold the property for no less than five years or the sale will be fully taxable.

Section 121, the “Universal Exclusion”, allows an individual to sell his residence and receive a tax exemption on $250,000 of the gain as an individual or $500,000 as a married couple. In order to gain this benefit, the investor will need to live in the property for an aggregate of 2 of the preceding 5 years.

After the property has been converted to a primary residence and all of the criteria are met, the property that was acquired as an investment through an exchange can be sold utilizing the Universal Exclusion. This strategy can virtually eliminate a taxpayer’s tax liability and therefore is a tremendous end game for investors.

24. Can I exchange a domestic property for a foreign one, or vice-versa?

Property located in the United States is not considered “like-kind” to property located in a foreign country. It is not possible to exchange out of the United States into foreign property, and vice-versa.

There has been case law that passed that supports exchanging from the States and into a US territory. There are fourteen US territories: American Samoa, Baker Island, Guam, Howland Island, Jarvis Island, Johnston Atoll, Kingman Reef, Midway Islands, Navassa Island, Northern Mariana Islands, Palmyra Atoll, Puerto Rico, Virgin Islands and Wake Island. It is important to speak with your legal counsel when considering this option.

Section 1031 allows domestic-to-domestic, and foreign-to-foreign.

25. Can I do a cash-out refinance prior to an exchange?

The whole point of the 1031 Exchange is moving investment money forward to invest in more property. Pulling money out tax free prior to the exchange would contradict this point. For this reason, you cannot refinance a property in anticipation of an exchange. If you do, the IRS may choose to challenge it.

If you wish to refinance your property you will want to make sure the refinance and the exchange are not integrated by leaving as much time in between the two events as possible. You can choose to refinance prior to the property going on the market (6 months to a year) or wait until after the exchange is complete and refinance the newly owned property.

26. What are the rules for a related party transaction?

A related party transaction is allowed by the IRS, but significantly restricted and scrutinized. The purpose for the restrictions is to prevent Basis Shifting among related parties. Using a third party to circumvent the rules is considered to be a Step Transaction and is disallowed. If your transaction is audited, the IRS will look at the chain of ownership for the property.

The definition of a related party for 1031 purposes is defined by IRC 267b. Related Parties include siblings, spouse, ancestors, lineal descendants, a corporation 50% owned either directly or indirectly or two corporations that are members of the same controlled group.

The restrictions vary depending on whether you are buying from or selling to a related party. The following lists guidelines for each.

Investor selling investment property to a related party:

2-year holding requirement for both parties.

Does not apply where related party also has 1031 Exchange; death; involuntary conversion.

2 years are tolled during the time there is no risk of loss to one of the parties (put right to sell property/call right to buy property/short sale).

Investor buying investment property from a related party:

Related party must also have a 1031 Exchange; or

Taxpayer’s deferment of capital gain is less than or equal to seller’s taxable gain from selling the property.

27. What’s the difference between sections 1031 and 1033?

Although IRC 1033 and 1031 both allow for the deferment of capital gain on property, the code sections operate and impact the taxpayer differently. IRC 1031 may provide more flexibility on the type of replacement property that can be acquired. IRC 1033 offers more flexibility on time constraints and receipt of funds.

Here is a quick summary of the differences.

IRC 1031

Pertains to the exchange of property used in “trade or business or investment.”

Do not report gain if property is exchanged for “like-kind” property (e.g., real estate for real estate).

A third party intermediary is required.

May not have actual or constructive receipt of sales proceeds from the relinquished property (all funds must be deposited with the exchange-accommodator).

180 days to replace the relinquished exchange property.

45 days to identify replacement property.

Net equity must be reinvested in property of equal or greater value to the relinquished property.

IRC 1033

Pertains to property involuntarily converted or exchanged (destroyed, stolen, condemned or disposed of under the threat of condemnation).

Do not report gain if property received is “similar or related in service or use” to the converted property.

An accommodator is not needed; the deferment is reported on Form 4797.

OK to directly receive payment/proceeds for the involuntary conversion.

3 years to replace real estate; 2 years for other property.No time restrictions during which the replacement property must be identified.

Proceeds must be reinvested in property of equal value to the converted property.